E-invoicing

What is E-invoicing? | Global overview

Discover the process of e-invoicing and global market maturity.

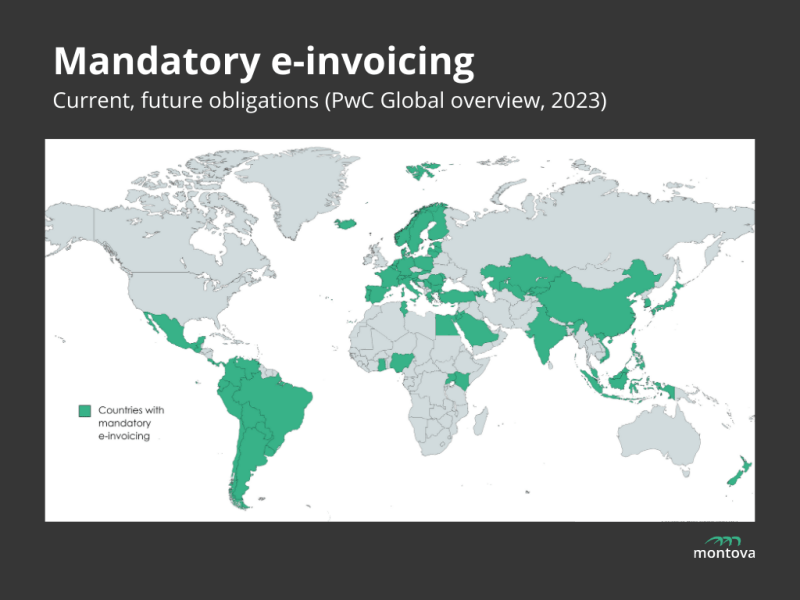

Due to its numerous advantages, electronic invoicing is experiencing rapid global adoption. Currently, 74 countries with significant economic influence have already implemented or promised to implement e-invoicing requirements across various sectors, encompassing B2B, B2C, and B2G transactions.

What is E-invoicing?

E-invoicing, or electronic invoicing, refers to the process of creating, sending, receiving, and processing invoices electronically without the need for physical paper documents. The digital exchange of invoice information is traded in a standardized electronic format such as UBL, EDIFACT, XML, Peppol, etc.

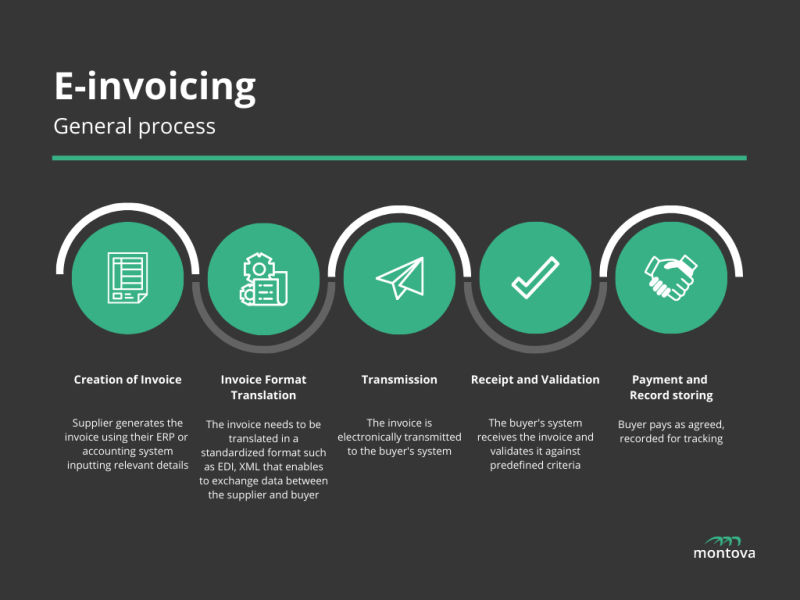

How does e-invoicing work?

Electronic invoicing (e-invoicing) processes can vary depending on the type of business transaction involved: business-to-business (B2B), business-to-consumer (B2C), and business-to-government (B2G). However, if we may create a general flow of E-invoicing, it can be summarized in 5 stages.

- Creation of Invoice

Supplier generates the invoice using their enterprise resource planning (ERP) or accounting system inputting relevant details for instance the buyer's information, invoice number, description of goods or services, quantities, prices, payment terms, etc. - Invoice Format Translation

The invoice needs to be translated in a standardized format such as XML, UBL that enable to exchange data between the supplier and buyer. - Transmission (Delivery)

The invoice is electronically transmitted to the buyer's system via email, direct system-to-system integration, a web portal, or through an e-invoicing/ EDI platform. - Receipt and Validation

The buyer's system receives the electronic invoice and validates it against predefined criteria. - Payment and Record storing

The buyer reviews and approves the e-invoice electronically. Once approved, the buyer pays as agreed. Both the supplier and the buyer maintain electronic records of the e-invoice for auditing, compliance, and reference purposes. These records can be stored securely in digital formats and accessed as needed.

The specific steps and systems could be different depending on the industry standards, e-invoicing solution, security scale, and compliance with local regulations.

Montova is a platform that offers e-invoicing and EDI solutions. Through our platform, those processes could be simpler and in a secure way. For more information, contact us.

Market maturity

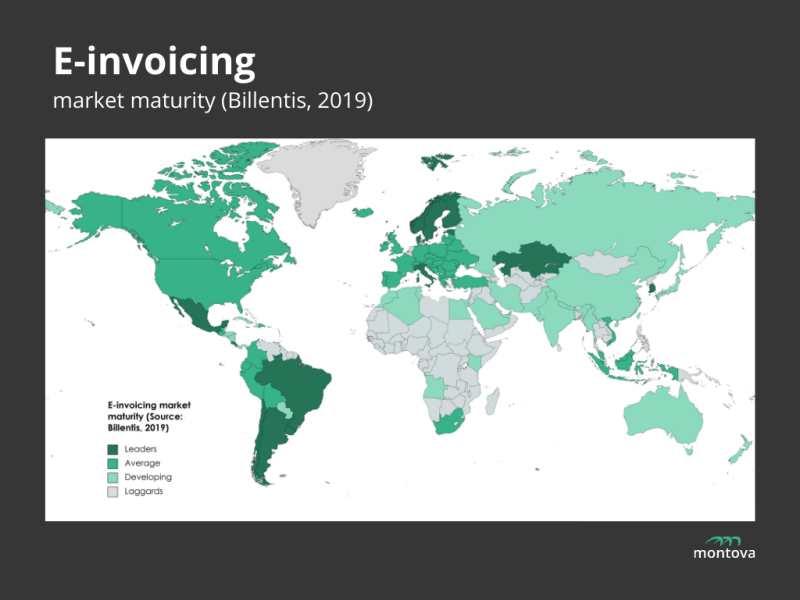

According to Data Bridge Market Research, the electronic-invoicing market is anticipated a compound annual growth rate (CAGR) of 25.40% for the forecast period of 2022-2029 and is expected to reach a market value of USD 6,014.71 million by 2029.

The following map shows the market maturity of electronic invoicing in the world.

Europe

Europe has tried to standardize and promote electronic invoicing to enhance efficiency, reduce costs, minimize errors, and facilitate cross-border trade. The implementation of Directive 2014/55/EU, mandating the use of e-invoicing in public procurement accelerated the transition towards e-invoicing adoption in Europe. Peppol is a network infrastructure that enables smooth EDI, including e-invoices, among businesses, and public procurement processes. The adoption of Peppol in Europe has resulted in improved interoperability, enabling smooth transactions throughout the continent and propelling the digital transformation of the invoicing process.

North America

North America has been growing steadily. While they are yet mandatory at a national level, e-invoicing solutions are widely used by businesses to simplify their invoicing processes and improve efficiency. The trend is more to standardize and increase EDI and XML-based formats.

Latin America

The region has achieved a high level of e-invoicing maturity, largely driven by comprehensive government initiatives. These initiatives are started with the goal of reducing tax evasion, improving tax collection, and transparency in commercial transactions. Countries such as Mexico, Brazil, and Chile have implemented strong e-invoicing frameworks, including mandatory electronic invoicing systems and real-time reporting requirements for tax compliance. Brazil's Nota Fiscal (NF), Nota Fiscal de Servicos Eletronica (NFSe), and Mexico's Comprobante Fiscal Digital (CFDI) are examples of e-invoicing models in this region.

Asia & Pacific

Asia Pacific has diverse regulatory environments and business practices across countries. Some countries have well-established e-invoicing ecosystems, while others are still in the early stages of adoption. The region's focus includes reducing paperwork, enhancing transparency, and improving cross-border trade. Countries like Singapore (B2G), South Korea (B2B), Indonesia (B2B), Vietnam(B2B), and Taiwan (B2C) have executed national wide e-invoicing obligations, and China, Japan, and Malaysia have announced for the future obligation in e-invoicing.

Africa & Middle East

E-invoicing adoption in these regions is gradually increasing. Governments in countries like Saudi Arabia, the United Arab Emirates, and South Africa are implementing e-invoicing initiatives to improve tax compliance and efficient and modernize business processes. The region's e-invoicing landscape is influenced by unique factors like a focus on reducing the shadow economy, increasing government revenue, and improving transparency. The diversity of languages, regulatory frameworks, and technological infrastructure are the challenges in developing standardized solutions.

The following graph indicates countries that currently have (55 countries) or are expected (+27 countries) to execute mandatory e-invoicing obligations.

Why it's important to implement

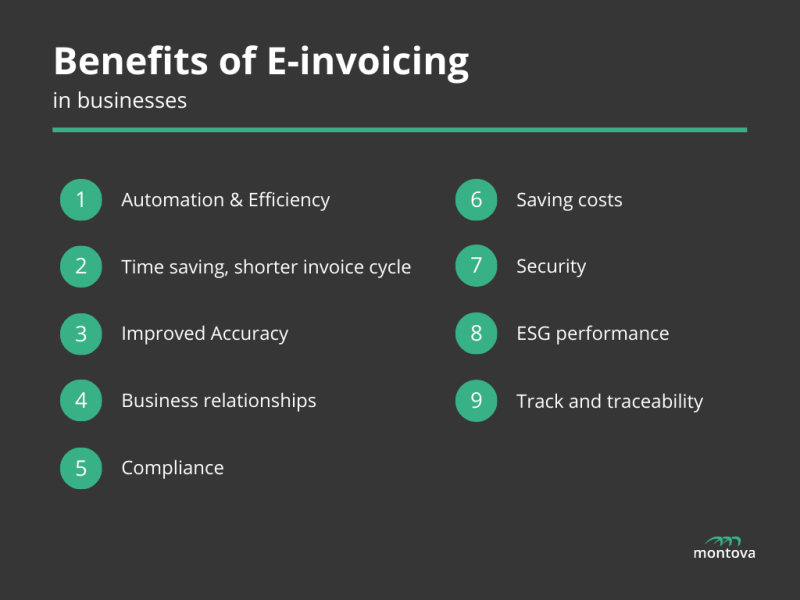

e-invoicing in organizations | Benefits

Not only because digitalization is a trend, but the benefits of e-invoicing are actually plenty. Here are things you can expect from electronic invoicing:

Process Automation & Efficiency

Automating e-invoicing streamlines the invoicing process, eliminating manual tasks such as data entry, sorting, and filing. This results in faster invoice generation, delivery, and processing, enabling organizations to focus on more value-added activities.

Time Saving (Faster invoice cycle and payment)

E-invoicing enables faster invoice approval, data matching, and payment processing. It takes off the delays caused by postal delivery, manual approvals, and physical handling, accelerating the overall payment cycle.

Improved Accuracy

E-invoicing reduces the risk of errors, mistakes, and loss of information and increases the availability and accuracy of data in the system.

Business relationships

E-invoicing supports smoother and more transparent communication and collaboration between suppliers and buyers. It provides real-time visibility into the invoicing status, facilitating better coordination, dispute resolution, and overall relationship management. And improves accuracy and reduced delay risks which helps to stabilize business relationships and the trust between them.

Compliance

Implementing e-invoicing is highly recommended to ensure compliance with tax regulations and invoicing standards, particularly for businesses operating in multiple markets. By adopting e-invoicing, businesses can establish a digital trail of their invoicing process, facilitating effortless retrieval of invoices, audit trails, and compliance documentation as required. Moreover, given the growing number of countries mandating e-invoicing, integrating an e-invoicing system within organizations can offer a competitive advantage and help prepare for future requirements.

Saving costs

E-invoicing offers significant cost savings by eliminating expenses related to manual processing, paper usage, printing, and postage. It reduces the risk of errors and delays, resulting in quicker payment cycles and enhanced cash flow management. Additionally, the efficiency of e-invoicing allows organizations to better manage their employees' time and tasks, enabling them to handle increased invoice volumes effectively.

Security

E-invoicing enhances security through data encryption, authentication, and access controls. It safeguards against document loss, tampering, and unauthorized access. Audit trails ensure compliance. Secure transmission protocols protect invoice data. Overall, e-invoicing improves security and mitigates risks.

ESG(Environmental, Social, Governance)

e-invoicing contributes to ESG goals by promoting environmental sustainability, reducing waste, enhancing operational efficiency, and aligning with stakeholder expectations. By adopting e-invoicing, organizations can positively impact ESG performance and demonstrate their commitment to sustainable and responsible business practices.

Track and traceability (transparency)

E-invoicing tracks transaction history and the entire document journey automatically, so you don't have to spend time doing it manually.

If you are interested in starting an automated e-invoicing system in your organization, reach out to Montova.